As climate change continues to pose a significant threat to the planet, industries worldwide are seeking ways to reduce their carbon footprint. The textile industry, known for its substantial environmental impact, is no exception. One promising approach to mitigating this impact is the implementation of a carbon tax. This blog explores the concept of a carbon tax, its relevance to the textile industry, and its potential benefits and challenges.

What is a Carbon Tax?

A carbon tax is a fee imposed on the carbon content of fossil fuels. It is designed to encourage companies to reduce their greenhouse gas emissions by making it more costly to emit carbon dioxide. The goal of a carbon tax is to provide a financial incentive for businesses to adopt cleaner, more sustainable practices and technologies.

Relevance to the Textile Industry

The textile industry is a significant contributor to global carbon emissions. From energy-intensive manufacturing processes to the widespread use of synthetic fibers derived from fossil fuels, the industry’s carbon footprint is considerable. Implementing a carbon tax in the textile sector can drive meaningful changes in how textiles are produced, processed, and disposed of.

Potential Benefits of a Carbon Tax

- Reducing Emissions:

A carbon tax directly targets emissions by making it more expensive to emit carbon dioxide. This financial pressure encourages textile companies to invest in energy-efficient technologies, renewable energy sources, and sustainable materials. Over time, this can lead to a significant reduction in the industry's overall emissions.

- Promoting Sustainable Practices:

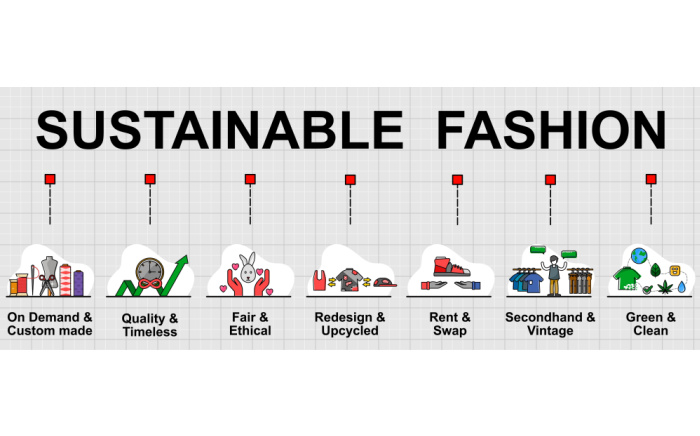

With a carbon tax in place, textile manufacturers are incentivized to adopt more sustainable practices. This can include using organic and recycled materials, improving energy efficiency in production processes, and minimizing waste. Such practices not only reduce emissions but also enhance the industry’s overall sustainability.

- Innovation and Competitiveness:

A carbon tax can spur innovation within the textile industry. Companies that develop and implement low-carbon technologies and processes can gain a competitive edge in the market. This drive for innovation can lead to the creation of new products and services that are both environmentally friendly and economically viable.

- Revenue for Climate Initiatives:

Revenue generated from a carbon tax can be used to fund climate initiatives and research into sustainable technologies. Governments can reinvest these funds into programs that support renewable energy, energy efficiency, and sustainable agricultural practices, further amplifying the positive impact of the tax.

Challenges of Implementing a Carbon Tax

- Increased Costs:

One of the main challenges of a carbon tax is the potential increase in production costs. Textile manufacturers may face higher expenses for energy and raw materials, which could be passed on to consumers in the form of higher prices. This can be particularly challenging for small and medium-sized enterprises (SMEs) with limited financial resources.

- Global Competition:

In a globally competitive market, textile companies operating in regions with a carbon tax may find themselves at a disadvantage compared to those in regions without such regulations. This could lead to a shift in production to countries with less stringent environmental policies, potentially undermining the effectiveness of the carbon tax.

- Implementation and Compliance:

Ensuring compliance with a carbon tax requires robust monitoring and enforcement mechanisms. Governments need to establish clear guidelines and regulations, as well as invest in the necessary infrastructure to track emissions and collect taxes effectively.

Conclusion

A carbon tax in the textile industry represents a powerful tool for driving sustainability and reducing emissions. While there are challenges associated with its implementation, the potential benefits in terms of emission reductions, sustainable practices, and innovation make it a worthwhile consideration. By encouraging textile companies to adopt cleaner technologies and processes, a carbon tax can play a crucial role in mitigating the industry's environmental impact and promoting a more sustainable future.

Back to Blog

Back to Blog